Treasury Risk Training Online Resources

Two new online & free course reference sites are now up at the following links

The Advance Treasury Risk Management Course Page

The Introduction to Risk Management Course Page

Sample Exam – Treasury Risk Management – Past Final Exam

The two treasury risk training courses were taught as sequential courses to SP Jain GMBA students in Dubai in summer 2012 over two weeks as part of the Financial Risk Management elective series. The Advance course focused on Excel model building using Treasury risk training themes covered earlier in the introductory course. The introductory course used foundation building materials from Value at Risk, ALM and Treasury Risk Management.

The objective was to mix and match treasury risk management frameworks, case studies and hands on risk model building exercises in Excel. The final exam (see practice past examination question above) focused on a real life treasury risk case study from the Margin Risk Management world. Where ever possible we used real treasury risk management case studies and data to ensure students developed a strong sense of what it takes to actually implemented treasury risk management models in practice.

Course content covers topics from the following core risk management themes:

-

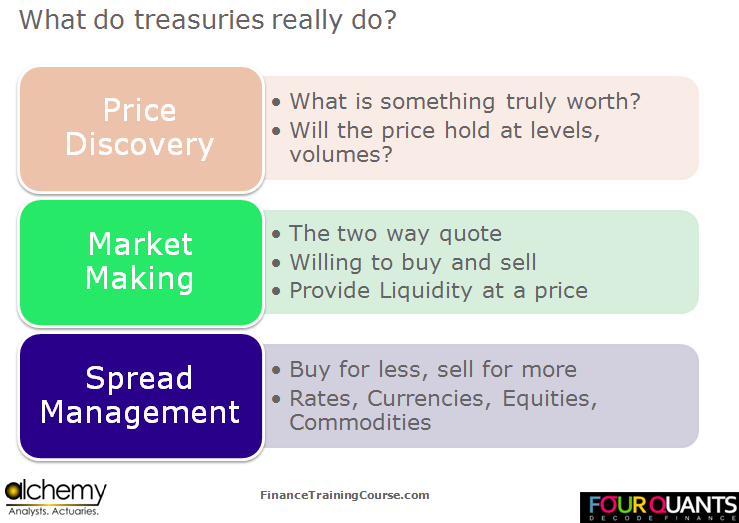

Introduction to Treasury Risk Management

-

Introduction to Value at Risk – Framework and case studies

-

Introduction to Delta and Higher Order Hedging for an Options Book

-

Asset Liability Management – Framework and case studies

-

Probability of Default models using Merton’s structured approach for FI Analysis

-

Capital Adequacy & Bank Regulation

Suggested training course instruction time is 36 hours spread over 12 days of classes with 3 hours per day. The outline and the course material require a heavy reading and in class modeling load and are not recommended for the light hearted.

While the first three themes in the course focused on Treasury Risk Management, the last 3 balanced the course material out by introducing credit risk (probability of default models for FI and counter party limit setting), Asset Liability Management (ALM) and Capital Adequacy analysis.

If you would like us to run either of the two course as an in-house workshop at your bank or treasury risk unit please drop me a line at jawwad at the rate alchemya dot com.