Short half day and full day format applied and corporate finance training courses coming soon to the Capital Club at DIFC in Dubai (UAE) and locations in Abu Dhabi and Al-Ain in collaboration with our DIFC Partners, Kinetrix Limited. Courses cover a range of hands on practical topics from treasury risk to project finance, from interest rate modeling to understanding commodities risk.

A joint venture managed by

.For our portfolio of financial services customers in the region and beyond.

Three courses, three outlines, one happening location

While Alchemy Technologies offers a portfolio of more than 20 domain specific treasury, risk and derivative pricing topics, the outlines below represent our most popular course offering.

Commodity Trades & Risk Management

The rising volatility in precious metals, petrochemicals and agricultural products has created an unprecedented opportunity to profit from market price movements. On the risk front there is a need to understand the impact of this volatility on trades, transactions and desks. By the end of this two day workshop participants will be able to:

- Appreciate the linkage between commodity markets (precious metals, crude oil), currencies and rates

- Trace the impact of monetary policy announcements on commodity markets

- Explain trading strategies using futures, options and exotic products

- Understand trading triggers

- Derive risk limits for counterparty exposures

Project Finance – Concepts and Applications

The workshop is aimed at account managers, bankers, risk managers, credit analysts and students interested in building a stronger understanding of the project finance space. At the end of this two day hands on workshop participants will be able to:

-

Understand the unique characteristics, benefits and issues associated with Project Finance.

-

Compare project finance with conventional corporate finance using a power system expansion case

-

Understand the role and importance of Project Finance in infrastructure and large scale investment projects and the role of Project Companies (SPVs) in Project Finance.

-

Identify key project risks and understand the techniques for mitigation of such risks in Power and Infrastructure project space.

-

Use Montecarlo simulation to test core assumptions, value drivers and linkages between interest coverage and capital structure of the SPV.

We achieve these goals by creating an opportunity for students to step into the shoes of all major stakeholders (sponsors, financiers, lenders, beneficiaries and managers), apply the primary principals of project finance, sensitivity analysis and risk mitigations on specific historical transaction and get comfortable with the concept of using project companies to align incentives. The course combines hands on model building, presentation, analysis and the application of creative thinking to structuring transactions and has a heavy case and workload.

Treasury products crash course

The workshop is aimed at non-treasury customer facing team members who work as facilitators and relationship managers between Treasury customers and the Treasury function at a bank.

The primary objective of this workshop is to help relationship, risk and limit managers better understand transaction, limits and pricing mindset from a Treasury point of view. Armed with this awareness and knowledge they can help customers understand the rationale behind a treasury price quote, leading to a quicker close and a higher yield on customer treasury transactions.

By the end of this workshop participants will be able to

- Explain primary treasury products, processes and functions of a treasury department to a non-treasury outsider.

- Work with pricing examples across basic treasury products including both Money Market and FX products.

- Follow the workflow of treasury operations and identify common exceptions and solutions from rate quotation to settlement.

- Identify suitable treasury products for specific customer needs involving Money Market and FX transactions.

- Calculate counterparty limits using PSR and PFE methodology.

About Kinetrix

Kinetrix is one of the leading providers of Governance, Risk and Compliance (GRC) advisory services. It provides a front to back service offering including Strategy and Operational Formulation, built on robust GRC frameworks.

Kinetrix is recognized as a thought leader aligning in depth experience, expertise and business philosophy to create efficient, growing and sustainable businesses for its clients from start ups SMEs, Large Corporations, Family Businesses and Governments. Headquartered in the prestigious Dubai International Financial Centre (DIFC) we pride ourselves in our strong record of service delivery, client driven approach, professional excellence and understanding of local market needs. Our network of offices and affiliates spans the region and to complement our service offenng to our clients. Kinetrix has selected strategic partners (such as Complinet) to provide additional valued expertise, technology products and service excellence.

About Alchemy Technologies

Founded in 2003, Alchemy has grown to be one of the leading Enterprise risk and Actuarial firms in the region with a portfolio of several blue chip customers. Alchemy’s enterprise, treasury and Basel II risk solutions have all been built over the last 6 years with feedback from International and local industry user groups.

The firm has won multiple product recognition awards including the MIT Business Acceleration Plan runners-up Award, the PASHA ICT Award for Best Financial Application as well as the Asia Pacific ICT Finalist for the Best Financial Application Category. Our products have now been show cased in Pakistan, Thailand, China, Malaysia, Singapore, Macau and the Middle East.

Alchemy’s product offerings include Risk Management and Treasury Management solutions, Obligor and Facility Risk Rating platforms, Financial Institution (FI) Limit Allocators, PD Calculators, custom financial model development and audits, interactive workshops, risk and actuarial advisory, Basel II compliant risk solutions for banks, insurance companies and portfolio managers.

1.0 Commodity Trades & Risk Management

The rising volatility in precious metals, petrochemicals and agricultural products has created an unprecedented opportunity to profit from market price movements. On the risk front there is a need to understand the impact of this volatility on trades, transactions and desks. By the end of this two day workshop participants will be able to:

- Appreciate the linkage between commodity markets (precious metals, crude oil), currencies and rates

- Trace the impact of monetary policy announcements on commodity markets

- Explain trading strategies using futures, options and exotic products

- Understand trading triggers

- Derive risk limits for counterparty exposures

|

Session

|

Title

|

Topics

|

|

One

|

Commodities – Context and Introduction

|

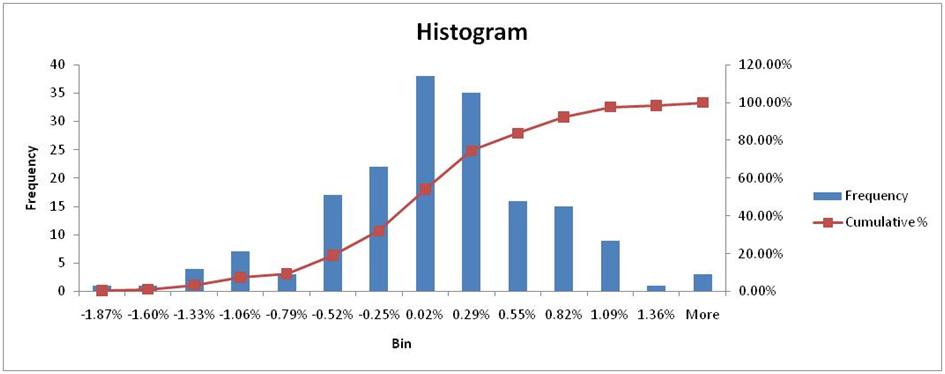

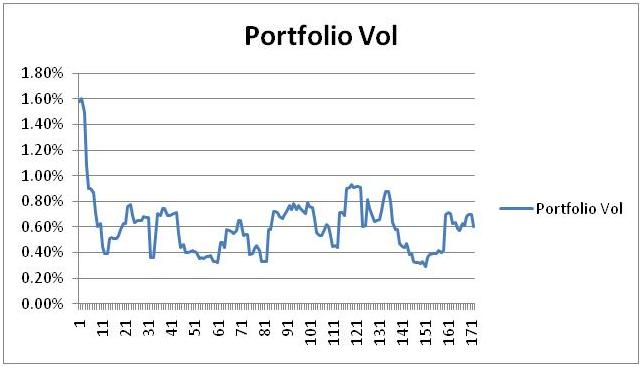

Core concepts

Volatilities

Trailing volatilities

Cycles

Announcement, Events & News

Interconnections & relationships

Trends

|

|

Two

|

Products & Trades

|

Futures, Forwards, Options

The ETF Trade and issues

Trading Strategies

Deep Out products for rising volatilities

Exotic Contracts

Structured Exposures

Nicholas Nassim Taleb on Markets, Trades and Risk

|

|

Three

|

Trading Tools

|

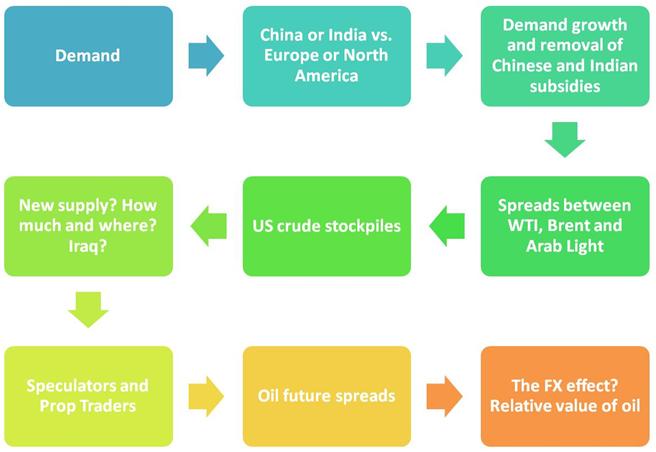

Analyzing the fundamentals of Oil, USD and Gold

From Fundamentals to Technical Analysis

Signals of strength and weakness

Range bound behavior

Shifting volatilities, trailing vols, vix and momentum

Behavioral Finance and market panics

Trading system or market analyst

|

|

Four

|

Treasury Limits & Portfolio Risk

|

Determining Stop loss limits

Optimizing Correlations and Nassim Taleb

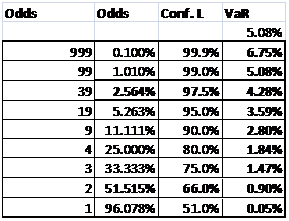

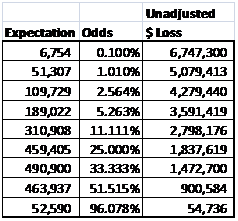

Calculating Value at Risk, Pre Settlement Risk (PSR) and Potential Future Exposure (PFE).

Linking PFE and PSE to counterparty limits.

Linking Stop loss and Value at Risk

|

2.0 Project Finance – Concepts and Applications

The workshop is aimed at account managers, bankers, risk managers, credit analysts and students interested in building a stronger understanding of the project finance space. At the end of this two day hands on workshop participants will be able to:

-

Understand the unique characteristics, benefits and issues associated with Project Finance.

-

Compare project finance with conventional corporate finance using a power system expansion case

-

Understand the role and importance of Project Finance in infrastructure and large scale investment projects and the role of Project Companies (SPVs) in Project Finance.

-

Identify key project risks and understand the techniques for mitigation of such risks in Power and Infrastructure project space.

-

Use Montecarlo simulation to test core assumptions, value drivers and linkages between interest coverage and capital structure of the SPV.

We achieve these goals by creating an opportunity for students to step into the shoes of all major stakeholders (sponsors, financiers, lenders, beneficiaries and managers), apply the primary principals of project finance, sensitivity analysis and risk mitigations on specific historical transaction and get comfortable with the concept of using project companies to align incentives. The course combines hands on model building, presentation, analysis and the application of creative thinking to structuring transactions and has a heavy case and workload.

Hand on Cases:

HBS Case: Calpine Power: From Project Finance to Corporate Finance

HBS Case: Asia Japan Cable

HBS Case: Chad Cameron Oil Field Development and Pipeline

|

Session

|

Title

|

Topics

|

|

One

|

A quick review of core concepts and techniques. Roles and incentives of key stakeholders. Using Monte Carlo simulation within models.

|

Introductions and game plan

Expectations

Everything you ever wanted to know about project finance in less than 90 minutes but were afraid to ask?

Using Monte Carlo simulation in financial models

Testing core drivers and business model

|

|

Two

|

Dissecting a project. From Project Finance to Corporate Finance

|

Calpine Power Case. Building the financial model for a power plant. Building a model for Calpine expansion strategy. Evaluating risk and capital structure.

|

|

Three

|

Handling Uncertainty: The Asia Japan Cable Company

|

Analyzing the business case for a submarine data cable and testing the model for uncertainty and price risk. Creating a framework for handling market risk.

|

|

Four

|

PPP: Politics in the developing world: The Chad Cameron Oil Pipeline

|

Working with the developing world and IFI’s. Funding development for development. Oil field development and transmission pipeline.

|

3.0 Treasury products crash course

The workshop is aimed at non-treasury customer facing team members who work as facilitators and relationship managers between Treasury customers and the Treasury function at a bank.

The primary objective of this workshop is to help relationship, risk and limit managers better understand transaction, limits and pricing mindset from a Treasury point of view. Armed with this awareness and knowledge they can help customers understand the rationale behind a treasury price quote, leading to a quicker close and a higher yield on customer treasury transactions.

By the end of this workshop participants will be able to

- Explain primary treasury products, processes and functions of a treasury department to a non-treasury outsider.

- Work with pricing examples across basic treasury products including both Money Market and FX products.

- Follow the workflow of treasury operations and identify common exceptions and solutions from rate quotation to settlement.

- Identify suitable treasury products for specific customer needs involving Money Market and FX transactions.

- Calculate counterparty limits using PSR and PFE methodology.

|

Session

|

Title

|

Topics

|

|

One

|

The Treasury Function – Introduction

|

The Treasury Function

Trade Flows (FX desk)

Trading, Investment & Portfolio Management

Proprietary Trading

Asset Liability Management

Liquidity Management

Treasury Markets

Foreign Exchange

Fixed Income /Money Market

Capital Markets

Related Terminologies

Four eyes

Confirmation

Settlement

Dealing System

Price discovery

Rate reasonability

Limit Management

Middle Office function

Risk Policies

Counterparty Limits

|

|

Two

|

Treasury Products – Workflow

|

The Treasury Function Operations

Front Office

Middle Office

Back Office

Trading exercise – FX products

Client – Relationship Manager

RM – Treasury Dealer

Treasury Dealer – Market

Quote, Confirm, Execute, Settle

Settlement exercise

Paper work, Limits, Counterparty confirmation, Back office verification & Validation

Customer quote

Rate quote, spread and margins

Treasury Operations

Treasury hierarchy (Chief Dealer, Inter Bank, ALM, FX, MM)

Limit Breach, Exception processing

Reserve Management (Cash, Liquidity)

|

|

Three

|

Products and Risk Limits

|

Product Families

Conventional treasury products (MM, FX)

Vanilla products (MM, FX)

Forwards, Futures, Options (Calls and Puts), Swaps (Profit Rates, Cross Currency), Caps and Floors

Exotics products and structured solutions for FX needs.

|

|

Four

|

Treasury Limits

|

Calculating Value at Risk, Pre Settlement Risk (PSR) and Potential Future Exposure (PFE) for Profit Rate Swaps and Forward contracts.

Linking PFE and PSE to counterparty limits

|

Facilitator profile

Jawwad Ahmed Farid is a Fellow Society of Actuaries (Chicago), a MBA from Columbia Business School (New York City) and a computer science graduate. During the last 19 years, he has worked as a consultant in North America, Pakistan and the United Kingdom with a number of blue chip clients including Hartford Life, Aegon, American General, Goldman Sachs, ING, Manu Life, Merrill Lynch, Met Life, Sun America, Nationwide, Sumitomo Mitsui Bank, Sun Life of Canada, Pacific Life, AllState, Fidelity Investments, Transamerica, Skandia, GE Financial Assurance, AXA Equitable and Washington Mutual Bank.

Jawwad Ahmed Farid is a Fellow Society of Actuaries (Chicago), a MBA from Columbia Business School (New York City) and a computer science graduate. During the last 19 years, he has worked as a consultant in North America, Pakistan and the United Kingdom with a number of blue chip clients including Hartford Life, Aegon, American General, Goldman Sachs, ING, Manu Life, Merrill Lynch, Met Life, Sun America, Nationwide, Sumitomo Mitsui Bank, Sun Life of Canada, Pacific Life, AllState, Fidelity Investments, Transamerica, Skandia, GE Financial Assurance, AXA Equitable and Washington Mutual Bank.

Jawwad’s core areas of expertise include Asset/Risk Management, Investments, Product Development & the Financial Services Back Office. Jawwad blends a rare combination of risk management, information systems, international standards, business and product development skill set side by side with his actuarial expertise. He is the author of three books on Entrepreneurship (Reboot), Commodity Markets (Understanding Commodities Risk) and Risk Management (Risk Application and Frameworks).

As an investment advisor Jawwad has advised a 3 billion US$ dollar life insurance fund in Pakistan on allocation and bid patterns for 10, 20 and 30 year bonds, a 30 million dollar Middle East fund on their ALM mismatch and fixed income strategy, a 10 million dollar fund on asset allocation and equity market timing in Pakistan. He has also worked with the securities regulator on assessing the state of the corporate bond market as well as issued valuation opinions on cross currency swaps, interest rate swaps, caps, floors, participating forwards and contingent liabilities for Exchange Guarantee Funds in the region.

Jawwad has worked directly as a founder, founding team member, mentor and advisor at multiple startups including two green field life insurance companies, multiple technology product businesses, financial services consulting operations, risk and investment advisory businesses, product focused distribution as well as micro insurance, micro pensions and micro finance startups.

In addition to being a PASHA CEC member and Treasurer he has also served as a judge at the Asia Pacific ICT Awards in Macau, Singapore, Kula Lumpur and Jakarta as well as at PASHA ICT Award in 2006, 2007, 2008, 2009, 2010. He currently serves as member of the oversight board for the PASHA Social Innovation Fund.

His regional client list includes First Gulf Bank, Riyad Bank, Ministry of Finance Malaysia, May Bank, Dubai Islamic Bank, Noor Islamic Bank, Dubai Bonds, Deutsche Bank, SP Jain, Marcus Evans, LSW International, State Bank of Pakistan, National Bank of Pakistan, Muslim Commercial Bank, Crescent Commercial, MyBank, Dawood Islamic Bank, KASB Bank, United Bank Limited, Pak-Kuwait Investment, Saudi Pak Commercial Bank, ABN AMRO, State Life Insurance, Dawood Family Takaful, Asia Health Care, Adamjee Insurance, Shell Pakistan, and International General Insurance.

The Capital Club, DIFC, Dubai, UAE

The Capital Club is Dubai’s premier private business club offering an elegant and welcoming ambience in which to mix and meet, to exchange ideas and to entertain guests. The Club is committed to the highest levels of comfort and cuisine, exceptional events and an unmatched level of personal service, at home and abroad.

Calendar, Dates and Timelines

Short half day, full day and two day formats starting end of October till early December covering Derivative Pricing, Interest Rate Modeling, Montecarlo Simulations, FX Derivatives, Quant Crash Course, Treasury Risk, Project Finance and Commodities Risk Models.

For details, fees and registration

Mr. Faheem Aziz, Kinetrix Limited, DIFC, Dubai – faheem.aziz@kinetrix.com

Mr. Jawwad Farid, Alchemy Technologies Pvt. Ltd, Karachi – jawwad@alchemya.com

Also see

Risk and Treasury Online Training Courses at Finance Training Courses Portal

Risk and Treasury Training Courses at DIFC, Dubai and the Capital Club

Jawwad Ahmed Farid is a Fellow Society of Actuaries (Chicago), a MBA from Columbia Business School (New York City) and a computer science graduate. During the last 19 years, he has worked as a consultant in North America, Pakistan and the United Kingdom with a number of blue chip clients including Hartford Life, Aegon, American General, Goldman Sachs, ING, Manu Life, Merrill Lynch, Met Life, Sun America, Nationwide, Sumitomo Mitsui Bank, Sun Life of Canada, Pacific Life, AllState, Fidelity Investments, Transamerica, Skandia, GE Financial Assurance, AXA Equitable and Washington Mutual Bank.

Jawwad Ahmed Farid is a Fellow Society of Actuaries (Chicago), a MBA from Columbia Business School (New York City) and a computer science graduate. During the last 19 years, he has worked as a consultant in North America, Pakistan and the United Kingdom with a number of blue chip clients including Hartford Life, Aegon, American General, Goldman Sachs, ING, Manu Life, Merrill Lynch, Met Life, Sun America, Nationwide, Sumitomo Mitsui Bank, Sun Life of Canada, Pacific Life, AllState, Fidelity Investments, Transamerica, Skandia, GE Financial Assurance, AXA Equitable and Washington Mutual Bank.