ALM and Liquidity Management Training Workshop

This advanced level ALM and Liquidity Training workshop serves as a refresher to liquidity management, with an emphasis on traditional models including gap analysis and earnings at risk, stress testing, scenario planning, policy making and simulations. Our first joint venture finance training workshop in Kula Lumpur with our Malaysian Partners LSW International scheduled for 27th and 28th January, 2011. 30 minutes from Kula Lumpur at the Holiday Villa Resort in Subang, Malaysia.

ALM Training Workshop Learning objectives

At the end of this workshop the participants will be able to:

- Work with the primary tools required to measure and manage ALM risk profile of a financial institution

- Measure liquidity and quantify the effectiveness of traditional measurement tools.

- Use scenario based methods, stress testing and simulations to highlight your ALM and liquidity risk profile.

- Develop assumptions for testing Maturity mismatch and liquidity risk for Internal Capital Adequacy Assessment.

- Assess and evaluate existing liquidity policies and contingency plans.

About ALM and Liquidity Management Workshop location and facilities

The Holiday Villa Subang is a premier business resort offers an ideal getaway for business and leisure. The Hotel is set on 6.8 acres of beautifully landscaped land overlooking a pristine lake while incorporating the luxuries of modern facilities. Its features 383 spacious guestrooms equipped with modern amenities, 10 food and beverage outlets that offer guests a choice of global cuisine, 18 convention and meeting facilities including three ballrooms and finally, a comprehensive range of sports and recreational facilities including an Olympic-sized swimming pool.

ALM Training workshop level: Intermediate and advance users. This advance level workshop is aimed at individuals responsible for asset liability management and risk management within banks, insurance companies and mutual funds. Familiarity with basic liquidity concepts, local markets, portfolio management and the Basel II framework. All participants are requested to arrange Laptops with a functional version of Microsoft Excel.

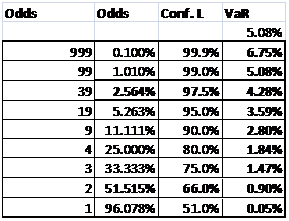

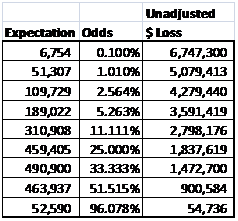

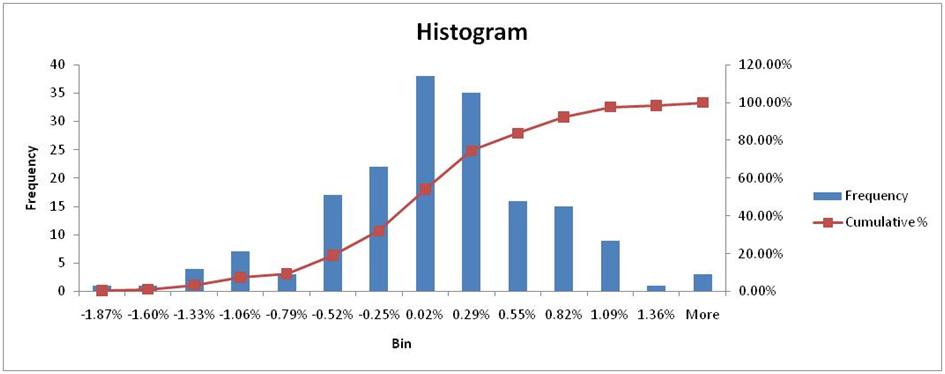

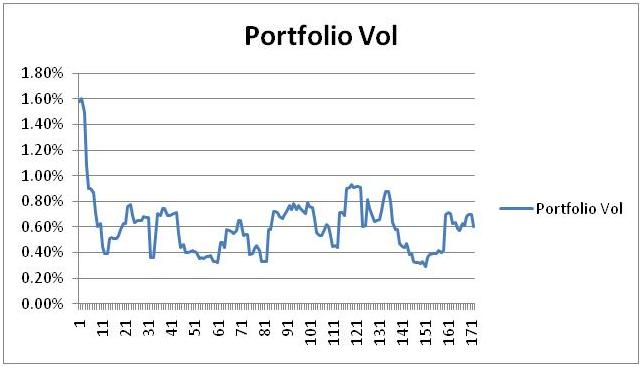

ALM and Liquidity Training Workshop Course OutlineLiquidity and ALM Models: Overview and introduction. Key terms and concepts. Duration, Convexity, Maturity mismatch, measuring mismatch, ALM models, assumptions and drivers. Basic tools – Price and Maturity GAP, MVE and NPV Analysis, Net Interest Income, Earnings at Risk, Cost to Close and Liquidity.

BancOne Case Study:

ALM and Liquidity Policies and Simulation: Structure, Policies, Tools, Stress tests, ICAAP and Scenario analysis for Liquidity. Building the contingency funding plan.

Facilitator profile

Facilitator profile

Jawwad Farid is the founder and CEO of Alchemy Technologies, an enterprise risk practice that builds and deploys risk, treasury, ALM, ICAAP, market and credit risk platforms. He is a Fellow Society of Actuaries (Chicago), a MBA from Columbia Business School (New York City) and a computer science graduate. During the last 18 years, he has worked as a consultant in North America, Pakistan and the United Kingdom with a number of blue chip clients including Hartford Life, Aegon, American General, Goldman Sachs, ING, Manu Life, Safeco, Merrill Lynch, Met Life, Sun America, Nationwide, Phoenix Life, Sumitomo Mitsui Bank, Sun Life of Canada, Pacific Life, AllState, Fidelity Investments, Transamerica, Skandia, GE Financial Assurance, Lincoln National, Ohio National, AXA Equitable and Washington Mutual Bank.

Jawwad’s core areas of expertise include Asset/Risk Management, Investments, Product Development and the Financial Services Back Office. Jawwad blends a rare combination of risk management, information systems, international standards, business and product development skill set side by side with his actuarial expertise. His regional client list includes Asian Development Bank, First Gulf Bank, Riyad Bank, Dubai Islamic Bank, Noor Islamic Bank, Dubai Bonds, Deutsche Bank, State Bank of Pakistan, National Bank of Pakistan, Muslim Commercial Bank, Crescent Commercial, MyBank, Dawood Islamic Bank, KASB Bank, United Bank Limited, Pak-Kuwait Investment, Saudi Pak Commercial Bank, ABN AMRO, InvestBank, Invest Capital Markets, State Life Insurance, Dawood Family Takaful, Asia Health Care, Adamjee Insurance, Shell Pakistan, International General Insurance and Securities and Exchange Commission of Pakistan. Jawwad is also a regular contributor to the Learning Corporate Finance portal as well as on the SP Jain platform where he teaches courses on Entrepreneurship, Risk Management and Derivative pricing to executive MBA students in Dubai and Singapore.

Jawwad’s expertise includes:

-

Appointed actuary.

-

-

Risk based capital, investment and portfolio optimization strategies.

-

Fixed Income, Foreign Exchange and Commodities (Oil) research.

-

Basel II market, credit and operational risk management framework.

-

Probability of Default modeling and Days Past Due analysis.

-

Centralized or distributed Middle & Back office design, review, integration, assessment and deployment for banks, brokerage, mutual funds, and insurance companies.

-

Derivative pricing, application and usage.

-

Valuation of contingent products, benefits and solutions in investments, portfolio management, life insurance, general insurance, finance and risk.

-

Development and conduction of individual and institutional skill development & capacity building programs.

For more details, pricing, registration and multi nomination discounts please contact

M. Shakila shakila@lswinternational.com or Leonard (leonard@lswinternational.com)

LSW International Sdn. Bhd. (765510-K)

623, Block B, Mentari Business Park

Jalan PJS 8/5, Bandar Sunway

46150 Petaling Jaya, Selangor Darul Ehsan

MALAYSIA.

Tel :+603 5637 2379

Fax :+603 5637 0366