First Published on Finance Training Course.com on 26th March 2011

I recently ran a presentation for a client where I had to justify setting risk limits at a pre-defined threshold for a treasury and investment management function, linking Stop Loss, Value at Risk and Management Action Triggers. The question a very astute board member asked me was a simple one:

How likely is this worst case loss and what would happen when it would actually occur?

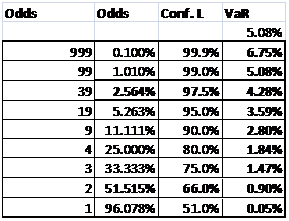

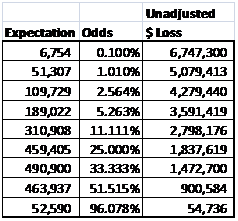

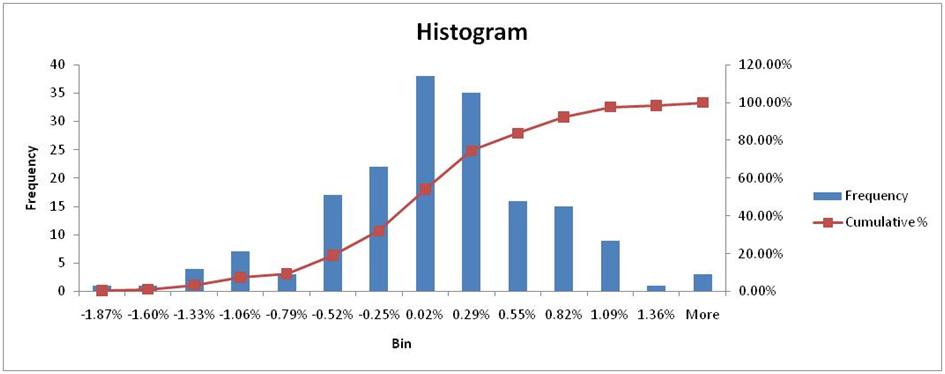

To explain my recommendation I had to lean on Nicholas Nassim Taleb and his suggestion of working with most likely loss which in this case (see table above) gave me even odds for a loss of .05%. From a pure expectation point of view it translated into 52,000 US$ alternate day (once in two days, 1:1 odd) for a 100 million US$ portfolio. That is the number the board was likely to see on every alternate day and rather than let the board sit idle and wait for the risk freight train to hit them at some point in time in the future while they were assured by their Worst Case Loss calculations, my and NNT’s suggestion was simple. Track deviation to your most likely loss rather than your unlikely loss. For two simple reasons:

- You have more data points to understand the distribution

- The number you quote to the board, the risk function and the treasury group is actually taken a lot more seriously given its likelihood of occurrence.

It also allowed me to link the concept of stop loss with risk limits by helping set a soft stop loss limit just beyond the most likely loss and a hard stop loss limit at the last known threshold of good data which interestingly enough sat between the 51% and 66% percentile threshold.

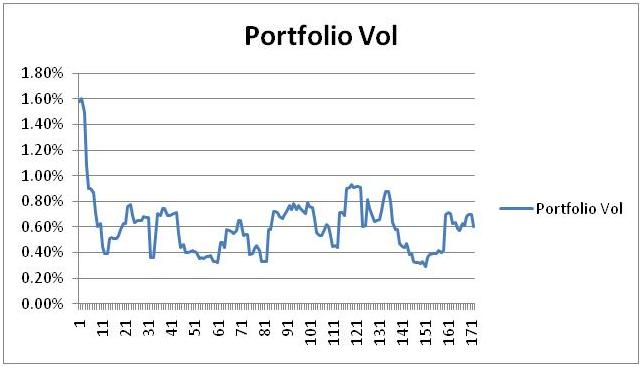

And if I was really really smart and had the right system and capabilities, I would move these limits around as the underlying portfolio volatility moved up and down in time.

The only exception to this rule was PSR limits (Pre-Settlement Limits) where I simply couldn’t walk away from worst case loss. So my question to you is

- Have you started thinking about communicating your risk results, targets, exceptions and breaches in Most Likely Loss terms or are you still using Worst Case Loss?

- Does your Board appreciate and understand and react better to Most Likely Loss or Worst Case Loss?

- Have you connected your stop loss triggers and thresholds to trailing market volatility?

If you would like to learn more about the topic of setting limits and using most likely loss rather than worst case loss please see our setting limits online video course at Finance Training Videos