Technical Sales & Trading Interviews – Understanding Greeks & Delta Hedging

Delta Hedging – Designed for audiences with:

- Job Interviews with Sales & Trading, Risk Management or Quantitative Strategies Desks.

- Deadlines for building, tweaking an inhouse dynamic delta hedging model for internal reporting, analysis and discussion.

- Training classes with fresh intake or interns who need to learn the ropes as of yesterday.

- Educating clients & bosses by testing and simulating scenarios cutting across strikes, spots, volatility, rates and time to expiry.

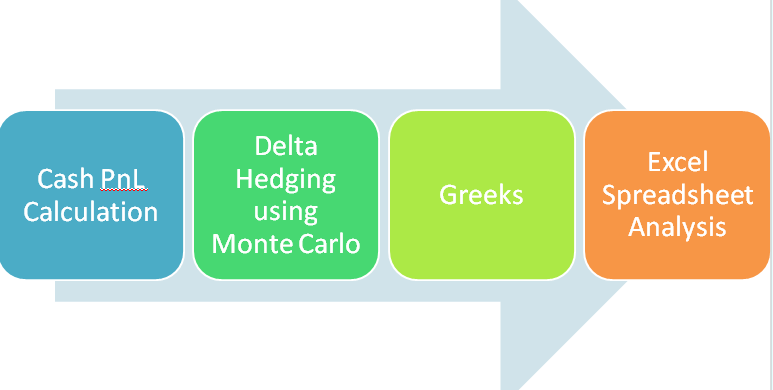

What does it include:

- A Delta Hedging Excel Monte Carlo simulation using our step by step, easy to follow, guide.

- A guide to Simulating Cash PnL for hedging your European Call & Put Exposure

- An analysis of PnL relationships and Option price sensitivities (Greeks)

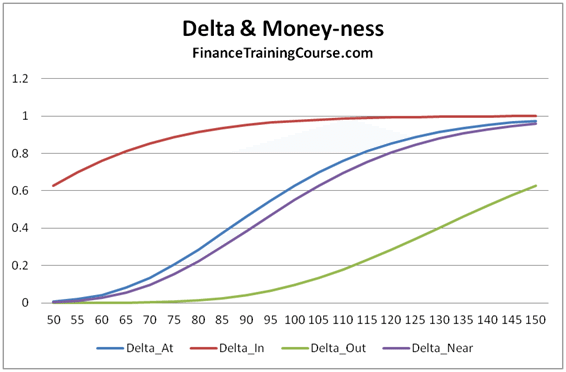

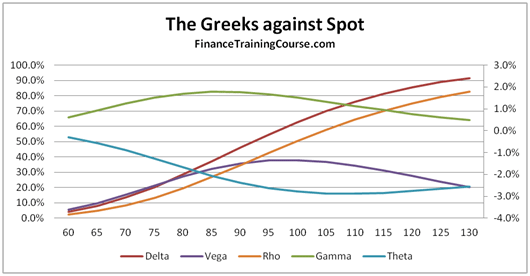

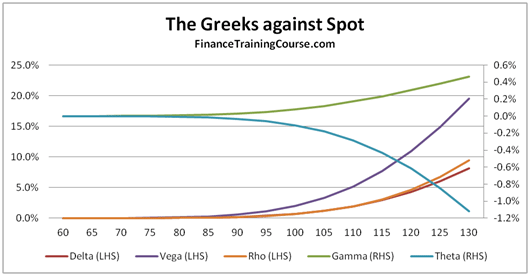

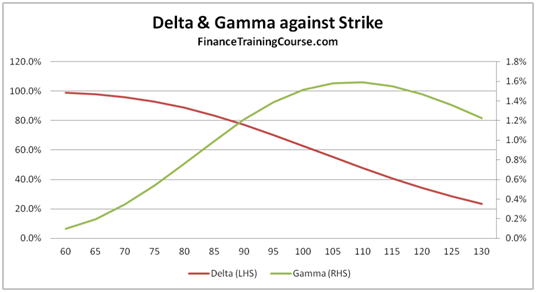

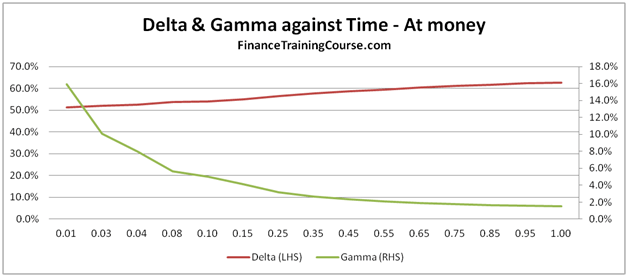

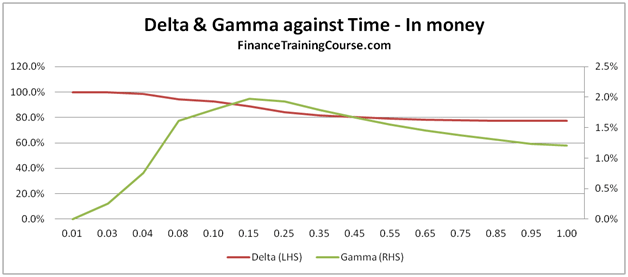

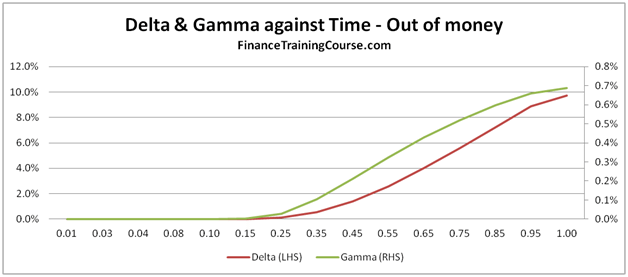

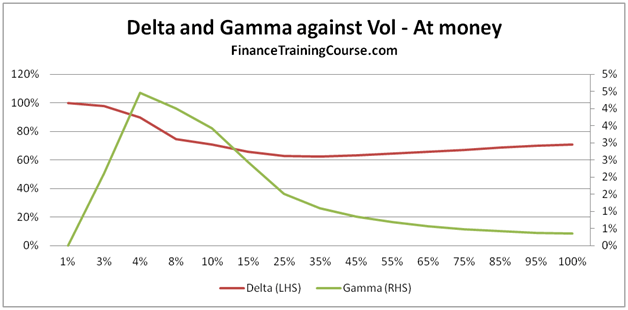

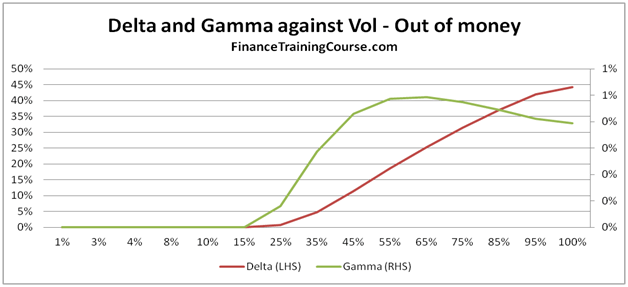

- Plots of Greeks against changing spot, strike, volatility, expiry & interest rates.

And

- A downloadable 70 page PDF guide for building the Delta Hedging Monte Carlo Simulation in Excel.

- A Greeks suspects gallery for common plots of Delta, Gamma, Vega, Theta & Rho.

- Step by step cash PnL calculation for a Call Option.

- A dissection of Delta, Gamma, Vega, Theta & Rho that doesn’t rely on the formula but uses graphs, intuition and thought experiments.

Understanding Greeks and Delta Hedging – Origins

What started off as a study note to address an intelligent question from a student and completely inadequate teaching on my part, turned into a monster side project that consumed the best part of a year.

The original question dealt with the behavior of Greeks, usage of higher order Greeks by traders and the concept of Delta hedging. It was supplemented by a request for recommended reading that I would care to suggest on this topic.

The challenge was that other than Nassim Taleb’s Dynamic Hedging there is literally nothing out there that you could refer a curious soul to. While Dynamic Hedging is the one and only guide on this topic, it generally leads to Cardiac infractions and CVA’s (Cerebrovascular Accident, not Credit Value Adjustments) in new students. To reduce mortality rate of fresh intakes in computational finance graduate programs and sales and trading desks, there was need for a beginners guide. Ideally with no stochastic calculus and no partial differential equations.

The end result: A study guide that walks through Option Price Sensitivities and Greeks behavior, helps you plot the same in Excel, use a dynamic Delta hedging simulation to get you comfortable with the majors and uses a Cash PnL simulation to dissect the minor Greeks.

It is not a conventional interview guide with interview questions. More like a survival kit that you can use to brush up on Greeks in a rush before the interview or before your exam. You don’t want to digest Taleb the night before; but you can play with an Excel sheet and tweak it to till you are able to connect the missing dots.

The complete package includes a 73 page study note and 3 Excel spreadsheets that you can cover end to end in about 3 hours and build intuition that can help you navigate trick questions and traps in the interview room.

Pick a copy under the early buyers promotion valid till 3oth November and take $60 dollars off the cover price.

Understanding Option Greeks – Free Sample content

The problem with Greeks is that the topic is so out there for most students and non-practitioners that we would rather ignore it. Who would actually care about the second moment (Gamma) or the third (Delta of Gamma) for that matter in the non-trading desk world. Plus by the time you actually get to a level that you can talk intelligently about the subject you are so short of oxygen that there is nobody left to talk to.

Understanding Greeks – Introduction

Understanding Greeks – Analyzing Delta & Gamma

Understanding Greeks – The Guide to delta hedging using Monte Carlo Simulation

Dynamic Delta Hedging Simulation – Cash PnL calculations

Using Dynamic Delta Hedging Simulation as a learning tool

Understanding Greeks – Quick Reference Guide to Delta, Gamma, Vega, Theta & Rho

Understanding Greeks & Delta Hedging – Motivation

I remember the pain I went through when I first tried to decipher Greeks, Continuous Time Finance and Monte Carlo Simulations. It was only when I met Mark Broadie and Maria Vassalou at Columbia that the cobwebs in my mind cleared up. While this book doesn’t deal with the original pain, it uses the approach Mark used to teach us a fairly difficult subject. Use Excel, Monte Carlo Simulation and intelligent questions (aka thought experiments).

The book is therefore packaged with spreadsheets that can be used interactively with relevant sections (see included Excel spreadsheets detail specification at the end of this post). As a student you can actually build the sheets using the step by step guides or simply use the packaged editions to answer the questions we ask.

And we ask many questions. In fact in one specific section we lead you all around town using the incorrect approach till you finally figure out the right answer. I have found this to be one of the most effective ways of ensuring comprehension and understanding.

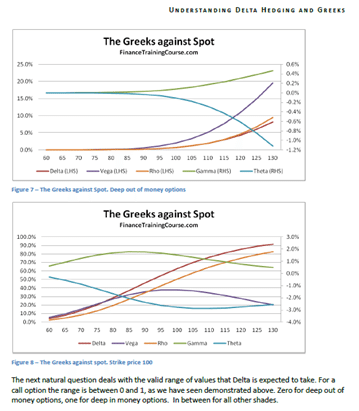

The 73 pages are primarily a guide to building a delta hedging spreadsheet for European Call and Put Options. Nassim Taleb emphasizes the use of a generator function to build trader intuition and we have included one. We then use the Delta hedging sheet to think about Delta, Gamma, Vega & Rho by asking questions that help reinforce that intuition. For Greeks we include an Excel calculation spread sheets as well as over thirty graphs that analyze Greeks behavior across changing Spot, Strikes, Volatility, Time & Interest rates.

To get the most out of the package, we recommend that you follow the book and the templates to build your Excel spreadsheets from scratch.

However the most important section of the book deals with Cash PnL from dynamic hedging. It turns out to be a terrific tool, once you link the profitability calculation to Greeks and use it to dissect components and contributors to PnL.

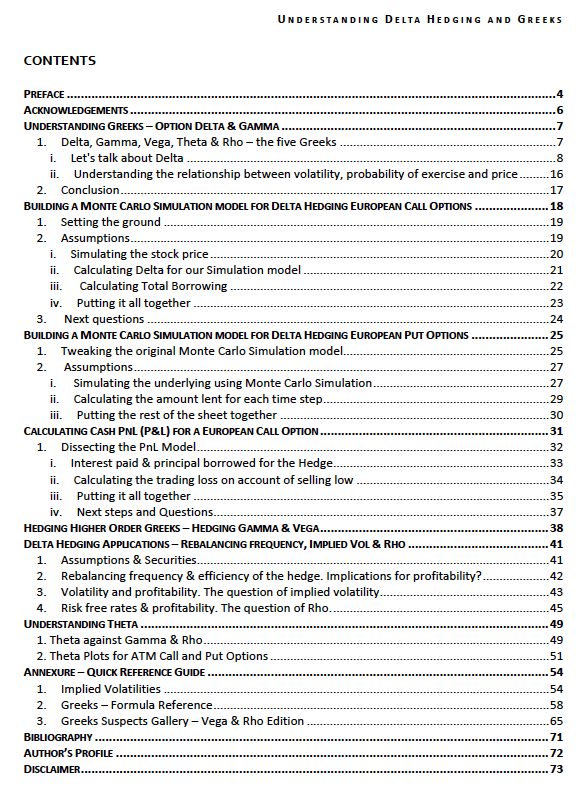

The Table of Content produced below has more details.

Pick a copy under the early buyers promotion valid till 30th November and take $60 dollars off the cover price.

Dynamic Delta Hedging – Monte Carlo Simulation – Greeks – Downloadable Excel File Guide

This product contains 3 EXCEL files.

1. Option Greeks Calculation & Graphs

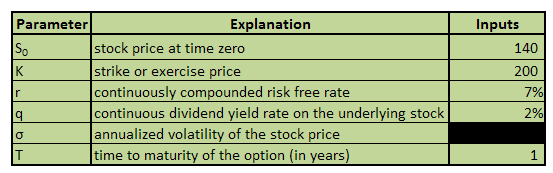

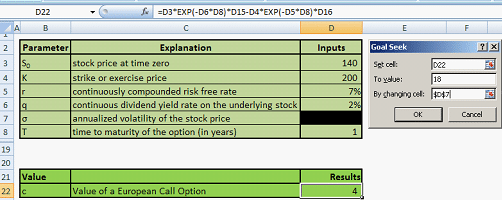

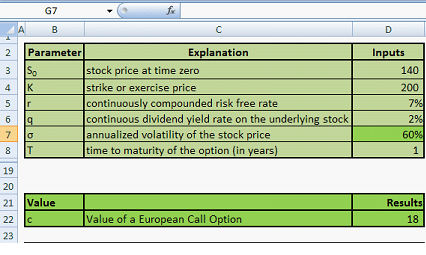

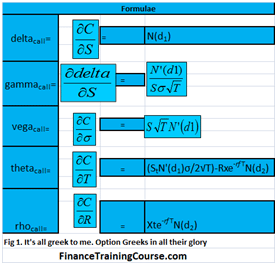

- Calculation of the Black Scholes option price for a European Call and a European Put option

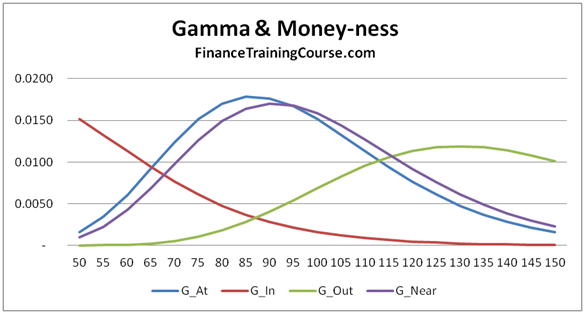

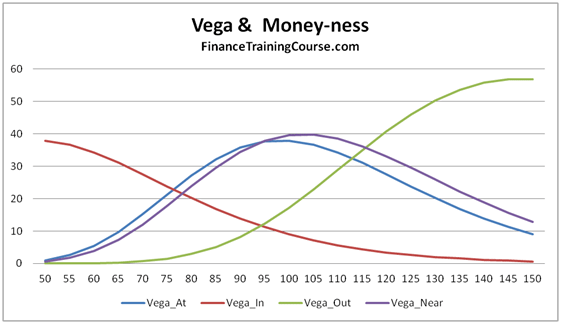

- Calculation of Greeks- Delta, Gamma, Vega, Theta & Rho- for a European Call and a European Put option

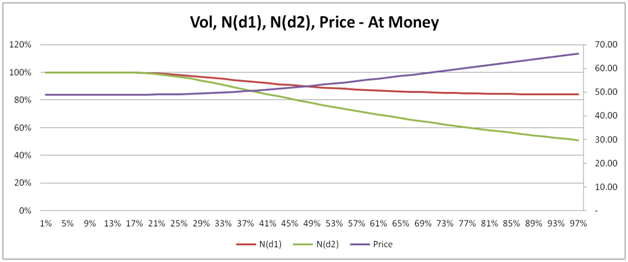

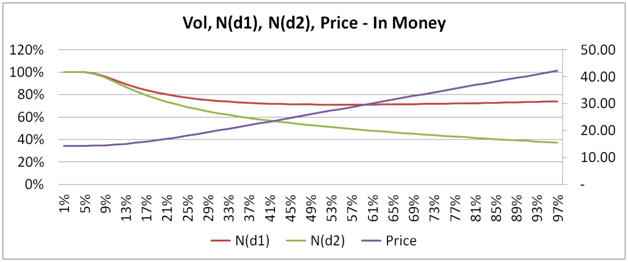

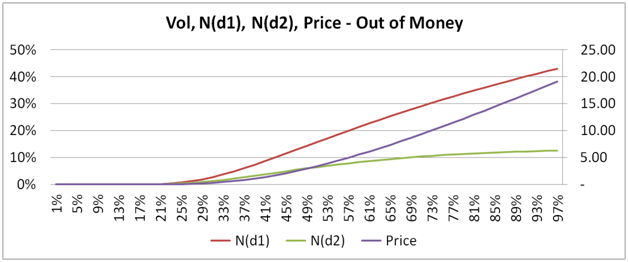

- Data table that captures the Black Scholes risk adjusted probabilities and option premium across a series of volatilities

- Graphical representation of Black Scholes risk adjusted probabilities and option premium against volatilities

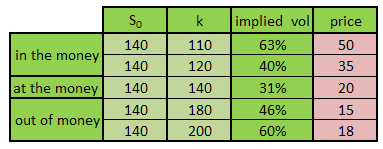

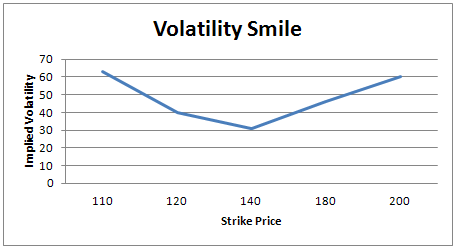

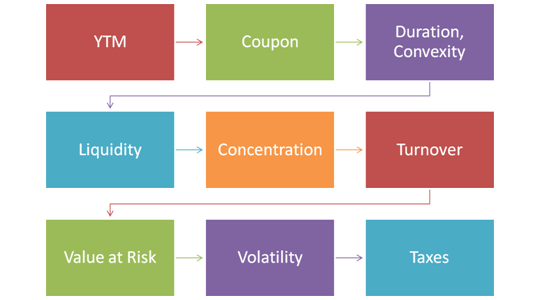

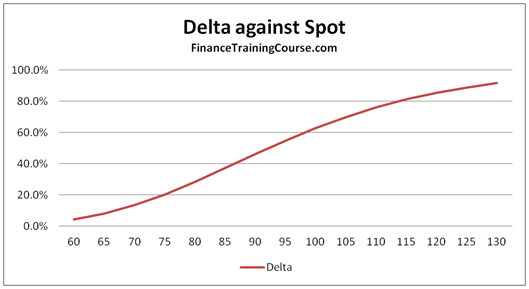

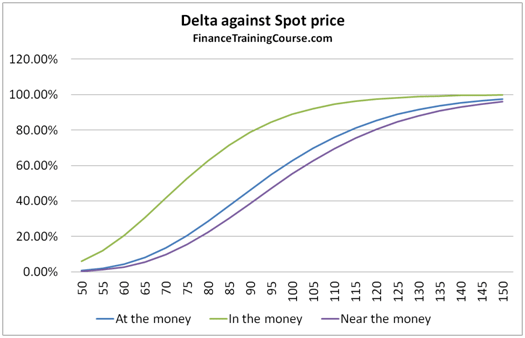

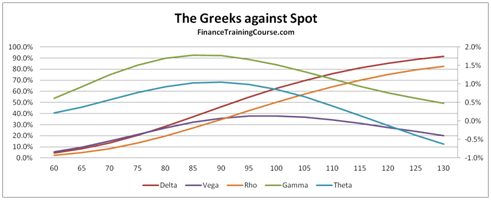

- Data tables that capture the sensitivity of the Greeks against Spot, Strike, Time to maturity, Volatility and the Risk Free Rate respectively

- Graphical representation of the sensitivities of the various Greeks against Spot, Strike, Time to maturity, volatility and risk free rate respectively

2. Dynamic Delta Hedging – Call Option – Monte Carlo Simulation – Cash PnL

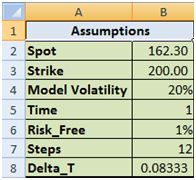

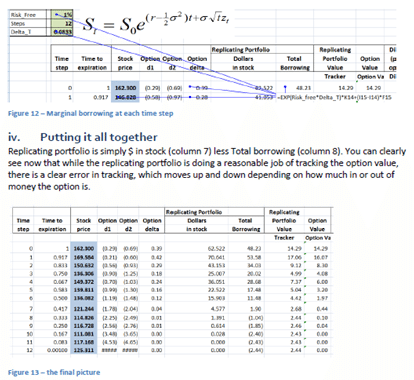

- Calculation of a 12-step Monte Carlo simulation model that generates the underlying stock price series

- Calculation of theoretical option values using the Black Scholes call option price formula

- Calculation of call option deltas at each rebalancing interval

- Calculation of a replicating portfolio that consists of a long position in Delta times the stock and a short position in the amount borrowed (net of the option premium received at inception) to fund the initial & subsequent incremental purchases

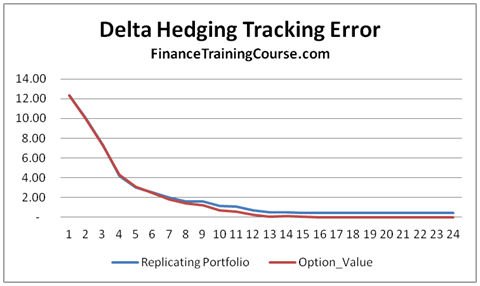

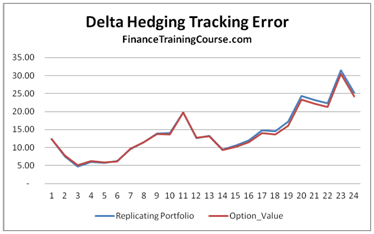

- Graphical representation of the theoretical option value and the replicating portfolio value over the life of the option

- Calculation of a tracking error for the difference between the value of the replicating portfolio and the theoretical value of the option

- Graphical representation of the tracking error across the life of the option

- Determination of the per period interest and principal portions of the amount borrowed

- Determination of the Gain (Loss) on sale of portions of the stock

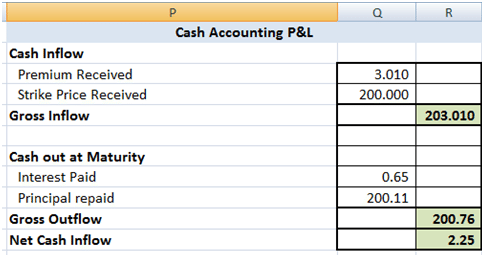

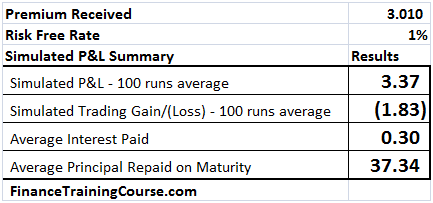

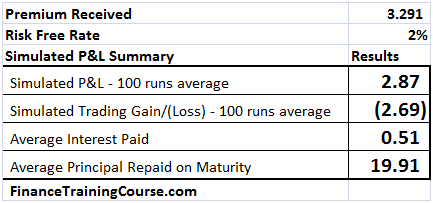

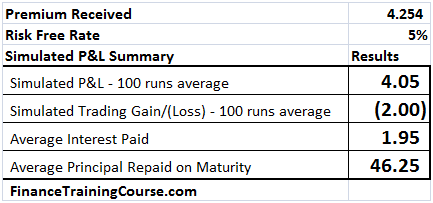

- Setting up a Cash Accounting P&L that shows cash inflows from option premium received and strike received in the event the option is exercise and cash outflows from interest and principal repayment on the amount borrowed

- A choice of including of excluding the option premium in determining the amount borrowed at inception. In this case the Principal repaid will equal the gain (loss) if the option is not exercised.

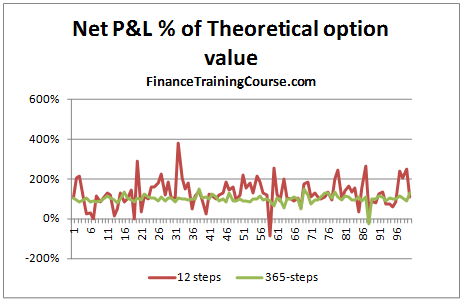

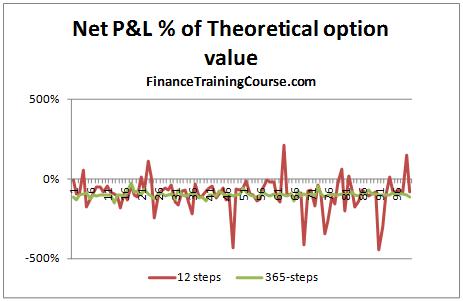

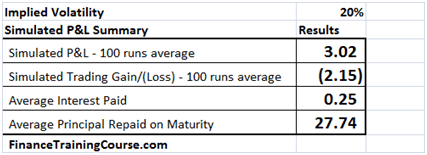

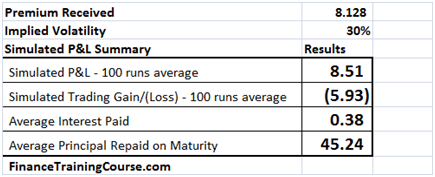

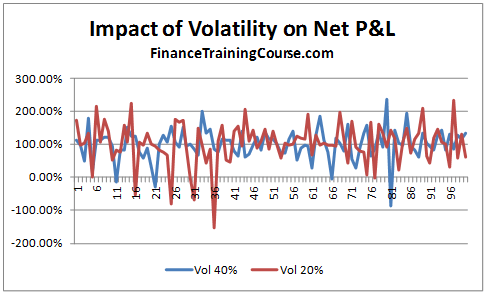

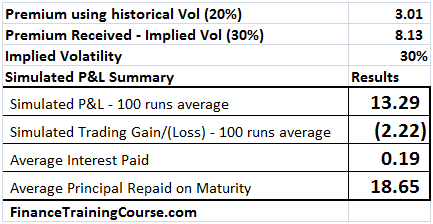

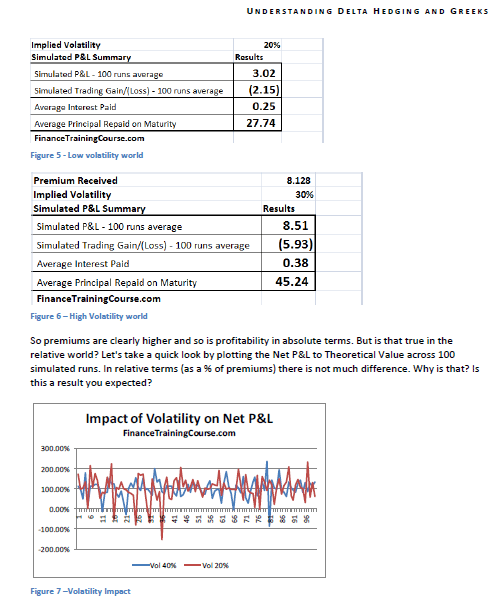

- 100 simulated runs including a graphical depiction of the results showing the Net P&L, Amount borrowed (principal & interest) and Gain/ Losses; and averages across the 100 runs for each of these items

3. Dynamic Delta Hedging – Put Option – Monte Carlo Simulation – Cash PnL

- Calculation of a 12-step Monte Carlo simulation model that generates the underlying stock price series

- Calculation of theoretical option values using the Black Scholes put option price formula

- Calculation of put option deltas at each rebalancing interval

- Calculation of a replicating portfolio that consists of a short sale of Delta times the stock and lending of the initial (net of the option premium received at inception) & subsequent incremental short sales proceeds

- Graphical representation of the theoretical option value and the replicating portfolio value over the life of the option

- Calculation of a tracking error for the difference between the value of the replicating portfolio and the theoretical value of the option

- Graphical representation of the tracking error across the life of the option

- Determination of the per period interest and principal portions of the amount lent

- Determination of the Gain (Loss) on closing of short sale positions

- Setting up a Cash Accounting P&L that shows cash inflows from option premium received, interest earned on amount lent and sales proceeds from short sales and cash outflows from strike paid if the option is exercised

- A choice of including or excluding the option premium in determining the amount borrowed at inception. In this case the sales proceeds from short sales will equal the gain (loss) if the option is not exercised.

- 100 simulated runs including a graphical depiction of the results showing the Net P&L, Proceeds from Short Sales, Interest Earned and Gain/ Losses; and averages across the 100 runs for each of these items

Pick a copy under the early buyers promotion valid till end of November and take $60 dollars off the cover price.

Related posts: